FOR BUSINESS OWNERS & C-LEVEL ONLY...

"How Much ERC Do I Qualify For?"

Answer just 3 questions to find out.

FOR BUSINESS OWNERS & C-LEVEL ONLY...

"How Much ERC Do I Qualify For?"

Answer just 3 questions to find out.

How It Works

Step 1:

See If You Qualify

Step 2:

Select Firm

Step 3:

Get Paid

Take our 45 second quiz to see if your business qualifies

We’ll recommend the best ERC accounting firm based on your quiz info

If you qualify, you’ll receive a check directly from the IRS

Step 1:

See If You Qualify

Take our 30 second quiz to see if your business qualifies

Step 2:

Select Firm

You’ll receive a check directly from the IRS

Step 3:

Get Paid

We’ll recommend the best cost savings firm based on your quiz info

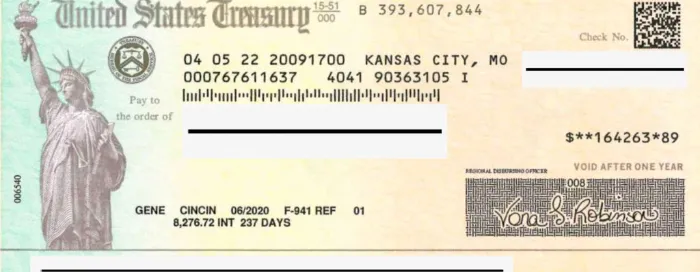

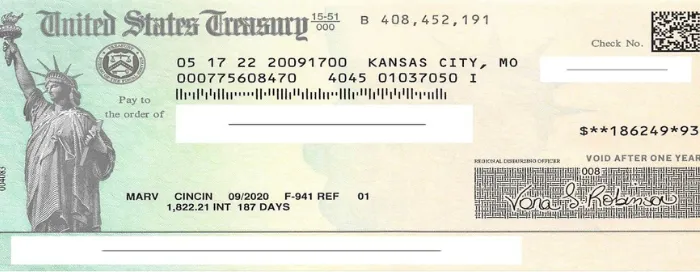

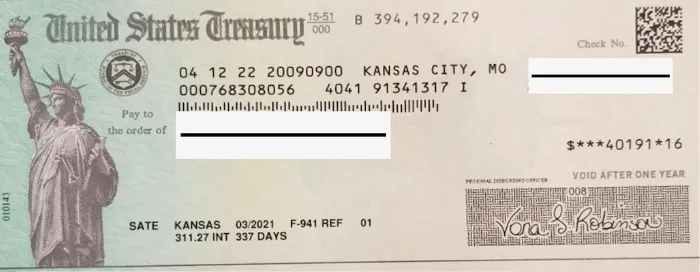

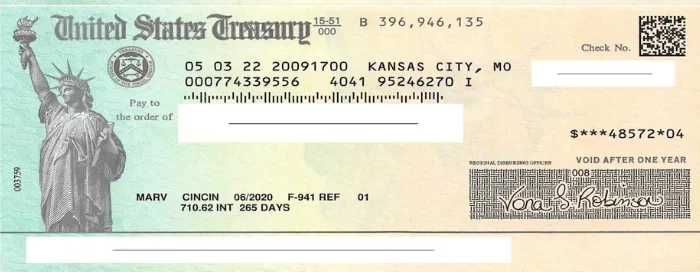

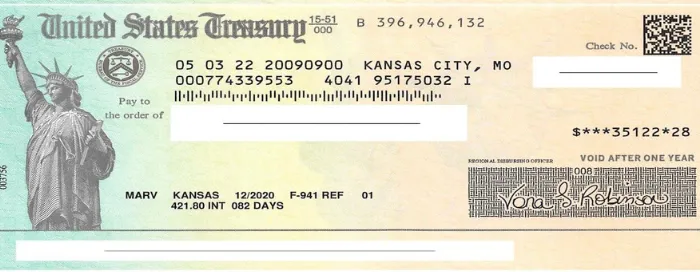

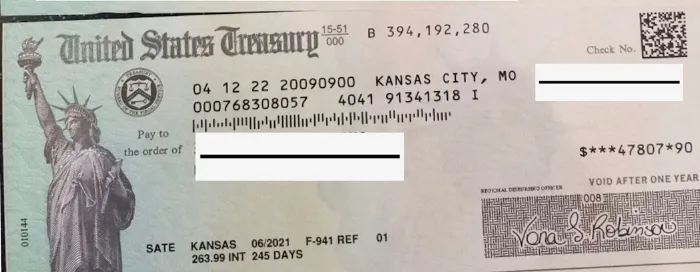

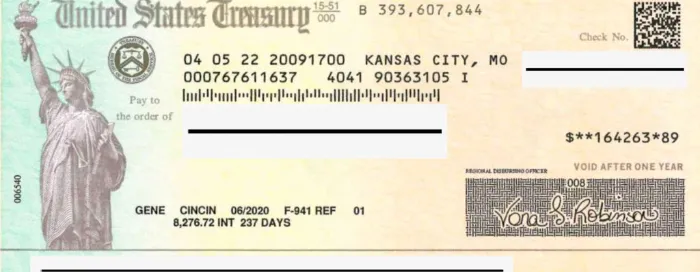

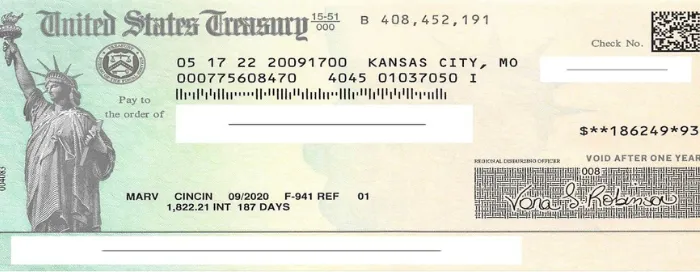

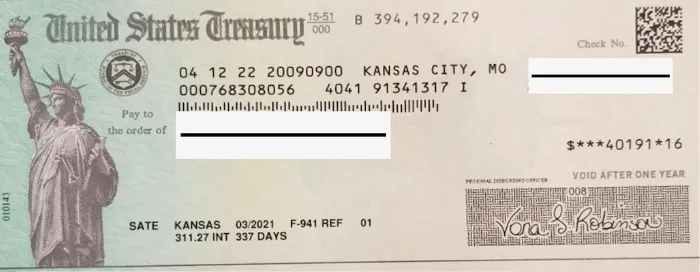

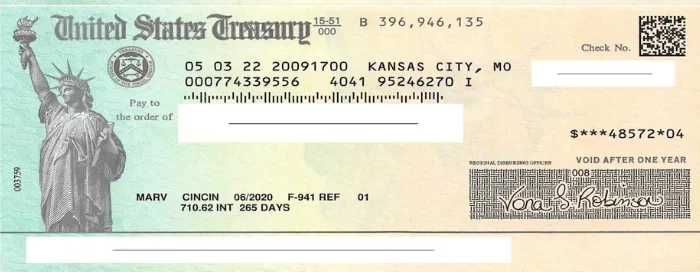

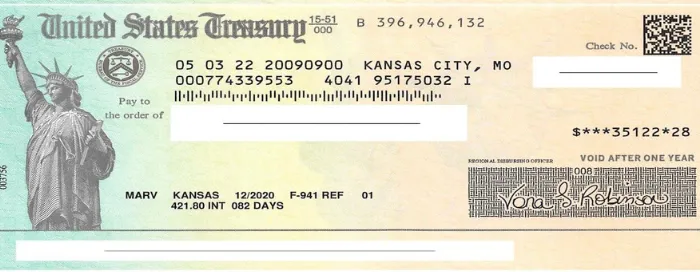

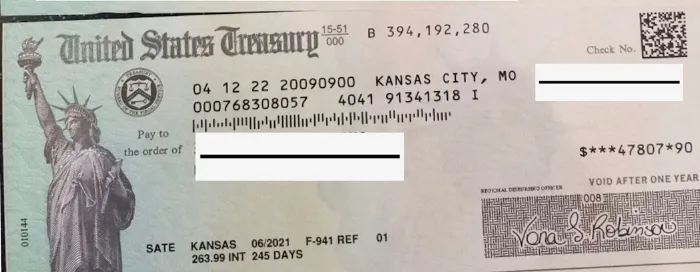

ERC Checks Like These Are Being Mailed Out By The IRS Every Week

Employee Retention Credit FAQs

What is the Employee Retention Credit (ERC)?

ERC is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic.

Established by the CARES Act, it is a refundable tax credit — a grant, not a loan — that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

-Up to $26,000 per employee

-Available for 2020 and the first 3 quarters of 2021

-Qualify with decreased revenue or COVID event

-No limit on funding

-ERC is a refundable tax credit

How much money can you get back?

You can claim up to $5,000 per employee for 2020. For 2021, the credit can be up to $7,000 per employee per quarter.

How do you know if your business is eligible?

To qualify, your business must have been negatively impacted in one of the following ways:

-A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, including supply chain disruptions as a result of government orders. Speak with an ERC expert to see if you qualify.

-Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

-A business can be eligible for one quarter and not another.

-Initially, under the CARES Act of 2020, businesses were not able to qualify for the ERC if they had already received a Paycheck Protection Program (PPP) loan. With new legislation in 2021, employers can now be eligible for both programs. The ERC, though, cannot apply to the same wages as the ones for PPP.

Why Us?

Fellow Business Owner,

We’re a team of fellow business owners that got negatively affected by Covid-19. We did everything we could to take care of our employees during the pandemic. But the reality is, Covid-19 hurt our businesses.

So, when the ERC program was launched and extended, we were thrilled. We spoke to a few cost savings firms to help us file, and were originally told we were going to get around $600K.

But then we found an incredibly knowledgeable and thorough firm that ended up getting us $2.1M! That’s $1.5M more than we thought we’d get, just by choosing the right firm that is an expert on the ERC program.

NOW, it's our passion to help other businesses just like us - businesses trying to do the right thing in these difficult times. And we want to help you choose the right firm, so you and your business get what you deserve from the ERC Program, assuming you meet the qualifications.

It’s simple, just click the “See if you prequalify” button. If you prequalify, we’ll recommend the right firm for your situation, so you can quickly get the maximum ERC amount allowed by law.

To your success,

ERC Assistant

Get Started